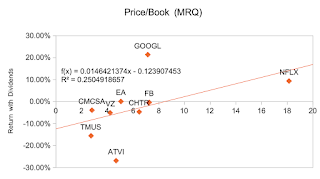

I have previously compared multiples and returns for stocks without isolating for a specific sector. The results were not particularly useful. PEG ratio was the only multiple that predicted stock performance in the "proper" direction, and it didn't do so with much consistency. I thought that if I analyzed a single sector, the results would be more meaningful. I compared the same multiples and tracked returns from the opening price on June 28, 2021 to the closing price on November 5, 2021 for nine large/mega cap stocks in the communication services sector (dividends were added to the returns). The results were not much better. The linear regression for PEG ratio and price/forward earnings for 2021 were the only multiples that produced the expected negative slopes. PEG ratio predicted positive returns more consistently than price/forward earnings. It might be worth noting that six of the nine stocks had negative returns, but those data points should still be valid; a useful multiple should predict the stocks that will lose the least value during a downturn as well as predicting those that will gain the most in a bull market.

Tuesday, November 9, 2021

Friday, October 15, 2021

Addicted to Low Interest Rates?

The charts below show the product of the effective federal funds rate and the unemployment rate on a monthly basis. The Federal Reserve is tasked with promoting "maximum employment and stable prices". Generally, it will try to move the federal funds rate lower when unemployment is high, and higher when unemployment is low, but these charts appear to support my feeling that near-zero rates have become the default. I made three charts: one beginning with 1990, one beginning with 2008, and one beginning with 2009. The most recent observation had the effective federal funds rate at .08 while the unemployment rate was 4.8 for a product of .384. While the federal funds rate has gone lower than this a few times, never has it done so with such a low unemployment rate.

Sunday, September 19, 2021

Will Choi Reduce Racial Disparity?

On September 8 Ramsey County Attorney John Choi “announced that his office would no longer prosecute most felony cases arising from low-level traffic stops, an effort aimed at reducing racial disparities in the criminal justice system,” the Star Tribune reported. The article states that “his office will decline to prosecute felony cases — such as those involving illegal possession of drugs or firearms — if evidence is discovered during a traffic stop for a nonpublic safety violation like expired tabs, objects dangling from mirrors or a burned-out taillight. The policy makes exceptions for cases that endanger public safety.” I'm struggling a little with Choi's apparent belief that illegal possession of firearms generally does not endanger public safety. Second amendment advocates should have a field day with this; how can anyone justify increasing gun regulation for the law abiding when it is now enshrined in policy that gun laws (at least in some cases) will not be enforced for criminals. What I wondered, however, is whether evidence supports the claim that moving police focus away from routine traffic stops will in fact reduce racial disparities in the criminal justice system. I looked at the 2019 arrests by offense and race from the Uniform Crime Reporting Program. The chart below shows the offenses sorted from highest to lowest by the percent of those arrested who are white.

Note that 'property crime' and 'violent crime' are aggregates of other crimes listed; the data presented here is not focused on number of arrests, rather it is focused on the tendency of arrests for specific crimes to predominately affect white or non-white people. There may be some disparity between the way that law enforcement and the census bureau collect data about race, but according to the census 76.3% of the country was 'white alone' in 2019, implying that white people are overrepresented in arrests for just three types of offenses: driving under the influence, liquor laws, and suspicion. You may be wondering what 'suspicion' is. The FBI defines it as “Arrested for no specific offense and released without formal charges being placed.” Out of arrests for all crimes in 2019, 69.4% of those arrested were white. Nine types of offenses exceeded 69.4% for white arrests.

So how is John Choi's plan likely to impact the racial breakdown of who gets prosecuted? Weapons offenses rank fourth from the bottom (55.6% white), so dropping these charges may reduce racial disparity in prosecution. But drug arrests rank sixth from the top (71.2% white), so a shift away from drug enforcement is unlikely to have much impact on the disparity. It strikes me that the crime most heavily weighted toward white arrests, driving under the influence, would probably be a common arrest during routine traffic stops. Isn't an open alcoholic beverage container or slurred speech one of the most likely pieces of incriminating evidence police might notice while looking through the window of a pulled over car? At the other end of the list, robbery and murder are the crimes least likely to involve the arrest of a white person, and by a large margin: 44.7% and 45.8% respectively. I suppose police might sometimes notice items that had been reported as stolen in a pulled over car, but I think this would be somewhat rare. If police find a dead body during a routine traffic stop, I would think that Choi would still carry out the prosecution. I guess I could be wrong.

One might question whether Choi is stepping outside his responsibilities. People sometimes accuse judges of 'legislating from the bench'; is Choi legislating from the attorney's office? Granted, there are probably many examples of elected leaders trying to influence policy in other areas of government, and discretion in prosecution is nothing new. In this case, however, Choi's concern apparently is not that those accused don't deserve to be prosecuted, but rather that he wants to persuade police departments to modify their policies on routine traffic stops. Aside from the question as to whether elected city leaders should be making decisions about how to run their police departments rather than Choi, I think there is a question about who suffers as a result of Choi's lesson to police departments. Assuming that prosecution really does reduce crime, Isn't it the general public that suffers for the sake of Choi's use of the attorney's office to manage police departments?

Thursday, July 29, 2021

Housing: more bubbles?

I decided to update the data from the post I made in February about Minneapolis home prices. In that post I charted the yearly change in the Case-Shiller Minneapolis Home Price Index using December-December numbers. Obviously, December data for 2021 isn't available, so I made a new chart using April-April data. For example, the bar for 2020 represents the change in home prices from April 2020 to April 2021. Changing the observed month has resulted in some notable changes to the chart. For example, 2009 moved from -2.0% to 10% by observing April rather than December. The trend of escalating recent price increases, however, remains. With the updated data, there are now only three years, rather than four, of increases greater than the most recent year. Moreover, the mean yearly increase was 4.2%, meaning that the last two years have been above average, with the most recent year more than double the average.

Thursday, June 17, 2021

Change in Minneapolis Homicide Rate

I should also clarify that these are increases in the rate, not percentage increases. The total homicide rate peaked in August 2020 at 4.18. The national murder/nonnegligent manslaughter rate according to the FBI was 5.0 for both 2018 and 2019 (the 2020 numbers are not yet available), but that's an annual rate. The annual rate for Minneapolis was 10.7 in 2019. Based on the numbers I obtained from the City of Minneapolis website, the 2020 rate should be 21.7. This is alarming seeing as it is much higher than any other year in recent history, but to keep things in perspective, the Jackson, Mississippi rate was 46.5 in 2019. Minnesota has the sixth lowest homicide rate in the country, but the geography of Minneapolis makes its crime statistics appear worse than they actually are. A large percentage of the metropolitan population resides in suburbs, thereby skewing the official population of Minneapolis. On the topic of population, the data here is based on the official 2019 and 2020 population estimates, 435,885 and 382,618 respectively. Yes, this suggests that the city's population decreased 12%. This may partly be due to differences in the way the estimates are made. The 2019 estimate is a projection from the 2010 census, while the 2020 number is based on the 2020 census. Still, I think it is reasonable to assume that the pandemic did result in some population decrease in Minneapolis, particularly because of fewer college students residing in the city. For 2021 I used the 2020 population number.

Tuesday, May 18, 2021

Multiples and Return for 32 Mega Cap Stocks

In August last year I published Multiples and Total Return for 33 Mega Cap Stocks. The results of my analysis then, which tracked the returns of stocks from November 2019 to August 2020, showed that only PEG ratio correlated with returns in the expected direction. For the charts below, I used the same multiple and entry point data, but extended to a much longer exit point. I assumed the stocks would be sold at the April 23, 2021 closing price. The results were not fundamentally different. Again, PEG ratio was the only multiple with a negative slope for its linear regression. I'm still hesitant to jump to the conclusion that multiples are not useful. Three of the four best performing stocks were in the information technology sector. All four of the financials sector and all four of the consumer staples sector stocks were in the bottom 18 performing stocks. This may suggest that, for the time frame analyzed, sector rotation drove performance more so than multiples. In a future analysis, I may compare performance and multiple correlation within a sector.

Some notes on the data:

The new analysis compares only 32 stocks rather than the original 33 because China Mobile Ltd was delisted.

I should clarify that where I've used the term 'total return' I meant the simple stock appreciation plus dividends; I did not make any calculations for reinvestment of dividends. For the time period and stocks selected I don't think dividend reinvestment would make a meaningful difference to the outcome.

The data here for Apple (AAPL) is split adjusted.

Tuesday, April 27, 2021

Timing the Market

"Don't try to time the market" is some of the most frequently given advice to beginner investors. I decided to do some testing of the theory against a frequently discussed strategy: "buy the dip". I backtested investing in Apple from February 24, 2020 to February 8, 2021. I assumed that one investor (the anti timer) bought one share at the opening price every Monday, while a second investor (the dip buyer) bought one share at the opening price on the first day following a down day (a day with a closing price lower than the previous close). The logic here is that an investor might identify a stock they are bullish on over the weekend. The anti timer would simply buy as soon as possible, while the dip buyer would wait for the price to decline. If the Friday before that weekend was a down day, then I assume both the anti timer and dip buyer would buy at the Monday opening price. I ignored weeks with a market holiday, and weeks with an ex-dividend date.

The anti timer outperformed the dip buyer in this analysis. The dip buyer paid a lower price in only six of the 39 weeks. The anti timer paid a total of $3,896.64, while the dip buyer paid $3,908.43 for the 39 shares. The close on February 12, 2021 (the final week of this analysis) was 135.37, making the 39 shares worth $5,279.43. Ignoring dividends, that is a 35.5% gain for the anti timer, and a 35.1% gain for the dip buyer. Not a huge difference. The logic against buying the dip is that equities generally increase over time, and the dips are unpredictable, so it is best to simply buy as early as possible. While this analysis confirms that, I wouldn't rule out the possibility that a more sophisticated dip buying strategy may be effective. This might be a topic for a future post.

The six instances of the dip buying strategy paying a lower price are in bold.

| Date | Monday Open | First Dip Open |

| Feb 24, 20 | 74.32 | 71.63 |

| Mar 2, 20 | 70.57 | 70.57 |

| Mar 9, 20 | 65.94 | 65.94 |

| Mar 16, 20 | 60.49 | 61.85 |

| Mar 23, 20 | 57.02 | 57.02 |

| Mar 30, 20 | 62.69 | 62.69 |

| Apr 13, 20 | 67.08 | 71.85 |

| Apr 20, 20 | 69.49 | 69.49 |

| Apr 27, 20 | 70.45 | 71.18 |

| May 11, 20 | 77.03 | 78.04 |

| May 18, 20 | 78.25 | 79.17 |

| Jun 1, 20 | 79.44 | 79.44 |

| Jun 8, 20 | 82.56 | 86.18 |

| Jun 15, 20 | 83.31 | 87.85 |

| Jun 22, 20 | 87.84 | 87.84 |

| Jul 6, 20 | 92.5 | 94.18 |

| Jul 13, 20 | 97.27 | 94.84 |

| Jul 20, 20 | 96.42 | 96.42 |

| Jul 27, 20 | 93.71 | 93.71 |

| Aug 10, 20 | 112.6 | 112.6 |

| Aug 17, 20 | 116.06 | 116.06 |

| Aug 24, 20 | 128.7 | 126.18 |

| Aug 31, 20 | 127.58 | 127.58 |

| Sep 14, 20 | 114.72 | 114.72 |

| Sep 21, 20 | 104.54 | 104.54 |

| Sep 28, 20 | 115.01 | 113.79 |

| Oct 5, 20 | 113.91 | 113.91 |

| Oct 12, 20 | 120.06 | 121 |

| Oct 19, 20 | 119.96 | 119.96 |

| Oct 26, 20 | 114.01 | 114.01 |

| Nov 9, 20 | 120.5 | 120.5 |

| Nov 16, 20 | 118.92 | 118.61 |

| Nov 30, 20 | 116.97 | 122.6 |

| Dec 7, 20 | 122.31 | 122.31 |

| Dec 14, 20 | 122.6 | 122.6 |

| Jan 4, 21 | 133.52 | 133.52 |

| Jan 11, 21 | 129.19 | 128.5 |

| Jan 25, 21 | 143.07 | 139.52 |

| Feb 8, 21 | 136.03 | 136.03 |

| Total | 3896.64 | 3908.43 |

Wednesday, March 17, 2021

Monopoly Strategy

Most people think it is all about Boardwalk and Park Place, but designing an algorithm for winning Monopoly is fairly complicated. Listed below is every property along with its location on the board, price, rent, price/rent ratio, and intrinsic value, which is the price the property would cost to make the price/rent ratio equal 12.14 (the average for all properties). For the utilities, I assume the dice roll is seven (which should be the average when rolling two dice). The big caveat here is that I didn't consider the various ways of increasing the value of a property (getting both utilities rather than one, multiple railroads, monopolies, houses, and hotels). Some might argue that additional value should be assigned to Mediterranean, Baltic, Park, and Boardwalk because they only require two purchases to get a monopoly.

| Property | Location | Price | Rent | Price/Rent | Intrinsic Value |

| Mediterranean Avenue | 1 | 60 | 2 | 30 | 24 |

| Baltic Avenue | 3 | 60 | 4 | 15 | 49 |

| Reading Railroad | 5 | 200 | 25 | 8 | 303 |

| Oriental Avenue | 6 | 100 | 6 | 17 | 73 |

| Vermont Avenue | 8 | 100 | 6 | 17 | 73 |

| Connecticut Avenue | 9 | 120 | 8 | 15 | 97 |

| St. Charles Place | 11 | 140 | 10 | 14 | 121 |

| Electric Company | 12 | 150 | 28 | 5 | 340 |

| States Avenue | 13 | 140 | 10 | 14 | 121 |

| Virginia Avenue | 14 | 160 | 12 | 13 | 146 |

| Pennsylvania Railroad | 15 | 200 | 25 | 8 | 303 |

| St. James Place | 16 | 180 | 14 | 13 | 170 |

| Tennessee Avenue | 18 | 180 | 14 | 13 | 170 |

| New York Avenue | 19 | 200 | 16 | 13 | 194 |

| Kentucky Avenue | 21 | 220 | 18 | 12 | 218 |

| Indiana Avenue | 23 | 220 | 18 | 12 | 218 |

| Illinois Avenue | 24 | 240 | 20 | 12 | 243 |

| B. & O. Railroad | 25 | 200 | 25 | 8 | 303 |

| Atlantic Avenue | 26 | 260 | 22 | 12 | 267 |

| Ventnor Avenue | 27 | 260 | 22 | 12 | 267 |

| Water Works | 28 | 150 | 28 | 5 | 340 |

| Marvin Gardens | 29 | 280 | 24 | 12 | 291 |

| Pacific Avenue | 31 | 300 | 26 | 12 | 316 |

| North Carolina Avenue | 32 | 300 | 26 | 12 | 316 |

| Pennsylvania Avenue | 34 | 320 | 28 | 11 | 340 |

| Short Line | 35 | 200 | 25 | 8 | 303 |

| Park Place | 37 | 350 | 35 | 10 | 425 |

| Boardwalk | 39 | 400 | 50 | 8 | 607 |

| Average | 12.14 |

Tuesday, March 9, 2021

Buying Teslas with Bitcoin

A brief comment must be made about recent predictions for bitcoin to become some kind of international currency standard. Personally, I've never managed to get excited about a nonproductive asset with no usefulness outside of its perceived value, but a lot of people have gotten excited about it, and made a lot of money with it. Tesla announced last month that it purchased $1.5 billion worth of bitcoin, and plans to start accepting it as payment. Below is a chart comparing bitcoin futures to the Euro/Dollar over the last year.

|

What I'm trying to understand is the fact that predictions for bitcoin adoption seem to be tied to its increasing value. For normal currencies, deflation is usually seen as a cause for major concern. One could imagine that if everyone is buying their Teslas with bitcoin, Tesla will have to continually decrease their prices (as the value of bitcoin rises). This will cause buyers to hold off on purchases. Why pay 1 bitcoin for a Tesla this week if it will probably only cost me .9 bitcoin next week? Meanwhile, Tesla is further stressed from the other side of the equation as the price it is now trying to sell cars for is less than what it paid workers and suppliers to build them. By the way, I originally planned to chart a few other major currencies for comparison, but they appeared to have lines pretty much identical to the Euro.

Sunday, February 28, 2021

Housing Bubble?

The chart below shows the yearly percent change in the Case-Shiller Minneapolis Home Price Index from 1990 to 2020 (using December to December numbers). The 10.2% increase in 2020 was big, but four of the 31 years analyzed had even bigger increases. The 2020 increase can still be viewed as unique, given that it happened during a recession. The other big increases happened in 2012, during the recovery from the Great Recession, and 1999 to 2001, around the time of the Dot-com bubble. The mean yearly change is 3.92%.

Tuesday, February 16, 2021

Meaning of The Killing of a Sacred Deer

This post contains spoilers for The Killing of a Sacred Deer.

Some have identified the meaning of Yorgos Lanthimos' movie The Killing of a Sacred Deer as detailing a tragedy of karmic fate. Steven caused the death of Martin's father; the movie has us watch the painful march toward an inevitable rebalancing of this transgression, despite all attempts to deny it or avoid it. In reality, the meaning is more complicated than this. The Killing of a Sacred Deer is about the hollowness of vengeance, and the search for meaning in familial relationships. The eating habits of the characters are key to demonstrating this. When we see Steven and Martin eating together at the diner, Steven asks Martin if he is going to eat his fries. Martin explains that he really likes fries and is saving them for last. Steven says that he does the same thing. Later in the movie, Martin is eating spaghetti, and recalls to Anna that he was once told that he eats spaghetti just like his father does. Martin explains that he later found out that everyone eats spaghetti the same way, and that he was even more disappointed by this realization than he was when learning that his father had died. Finally, at the end of the movie, we see the Murphy family eating at the diner while Martin sits at the counter. We see Kim eating her fries without a bite taken from her hamburger. It's easy to view Martin's role in the movie as a messenger from the karmic forces of the universe, but things might make more sense if we view him as more of a protagonist. Martin wanted Steven to replace his father. He took their commonality in the way they eat fries as a sign that such a relationship was warranted. Martin believed that with Bob dead, he would be able to take Bob's place in the Murphy family. The final scene illustrates the hollowness of Martin's vengeance. The family remains together, and Martin remains separate, sitting alone at the counter, and furthermore, vexed that Kim retains her place in the family despite the fact that she doesn't eat fries the way her father does.

Sunday, January 31, 2021

What is a WallStreetBets?

The GameStop (GME) saga is certainly unprecedented, at least in some ways, but some have ascribed an anti capitalist narrative to it that really isn't accurate. I have actually followed the WallStreetBets Reddit sub since late 2019, back when it had fewer than a million members. While it may have some complaining of 'hedge fund manipulation', it is anything but anti capitalist. Political discussion is officially not allowed on the sub, but I would describe the users as generally pro Trump. Moreover, discussions on the sub are laced with pejorative use of the words 'gay' and 'retard', and the humor that dominates the sub would be found to be offensive by many on the political left. In fact, what permeates the sub more than anything else is an idolization of wealth. In fact, Martin Shkreli ("Pharma Bro") was supposedly active on the sub before going to prison. I can't confirm whether Shkreli really posted on the sub, but I can say that he is still well regarded by WallStreetBets members. I don't really state these things to say that I have any ill will toward WallStreetBets members, I think a lot of them are just young people who might be a little misguided, but my point is that the narrative that some people have ascribed to them is not accurate.

The second point that must be made, and perhaps the more important one, is that people should seriously consider whether demanding that Robinhood allow unrestricted trading on GME is irresponsible. The most revered style of trade in the WallStreetBets community is the 'YOLO'. This generally means a high risk/high reward options play that someone places a large amount of money into. Often, the implication is that they are using all the money available to them. In some cases, this includes maximum margin, student loan money, and maxing out credit cards. Granted, this may just be talk, but in the case of GME, the fervor is so intense that I think many actually did this. I don't see any reason that Robinhood would want to protect hedge funds. The reasons they stated for restricting trading appear to be true. Ironically, the first time Robinhood and WallStreetBets were in the news together, it was because a WallStreetBets user had opened a box spread position that he didn't understand the risks of. It put him about $58,000 in debt, and Robinhood was harshly criticized for allowing such high risk trades on its platform.

This brings me to the third point, the question of how this will all end. There are plenty of financial journalists doing much more in depth analysis than I have, but I will make a few comments about the future of GME. Firstly, many people have referred to a hedge fund going bankrupt, and this needs to be corrected. Melvin Capital and Citron both remain solvent after closing their short positions on GME. According to S3 Partners, the value of GME stock held short is about the same as it was before the short squeeze. Many on WallStreetBets are convinced that Melvin Capital didn't really close their position. This doesn't make sense, because then there would not have been a short squeeze. More likely, is that other hedge funds have taken new short positions. It is likely that the new short positions were taken by larger funds that have calculated the risk of another short squeeze, and feel confident. Given that the stock has gained about 600%, one could calculate that generating another short squeeze would require six times the money. Moreover, some of those GME holders might be paying 18% interest on the credit cards they used to finance their purchases. And of course, I can't end the discussion without looking at GameStop's fundamentals. I compared GME to four companies with very similar market capitalizations. (Total Equity is most recent quarter, net income is last reported annual net income)

Company Market Cap Total Equity Net Income

Old Dominion Freight Line (ODFL) 22.8B 3.17B 616M

SVB Financial Group (SIVB) 22.7B 8.22B 1.21B

PG&E (PCG) 22.7B 20.8B -7.64B

Gamestop (GME) 22.7B 332M -471M

Coupa Software (COUP) 22.4B 413M -90.8M

Surprisingly, GME doesn't look too bad in this group, but at the rate it is loosing money, total equity will be negative before the end of the year.

There is another discussion that could be had about whether short selling is actually bad. The upward pressure when short sellers buy to cover counters the downward pressure from the short sale, so I don't think long term investors should be concerned about shorting. In the end, companies don't go bankrupt because of short selling or a decline in stock price generally. Companies go bankrupt because people stop buying their products.