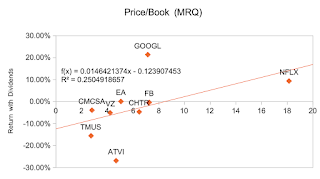

I have previously compared multiples and returns for stocks without isolating for a specific sector. The results were not particularly useful. PEG ratio was the only multiple that predicted stock performance in the "proper" direction, and it didn't do so with much consistency. I thought that if I analyzed a single sector, the results would be more meaningful. I compared the same multiples and tracked returns from the opening price on June 28, 2021 to the closing price on November 5, 2021 for nine large/mega cap stocks in the communication services sector (dividends were added to the returns). The results were not much better. The linear regression for PEG ratio and price/forward earnings for 2021 were the only multiples that produced the expected negative slopes. PEG ratio predicted positive returns more consistently than price/forward earnings. It might be worth noting that six of the nine stocks had negative returns, but those data points should still be valid; a useful multiple should predict the stocks that will lose the least value during a downturn as well as predicting those that will gain the most in a bull market.